Retirement Program

People and Culture

- Home

- About Us

- Benefits

- Benefits Offered

- Dental Insurance

- Employee Assistance Program

- Flexible Spending Account (FSA)

- Health Insurance

- Health Savings Account (HSA)

- Life Insurance

- Nice Healthcare

- Paid Leave

- Retirement Program

- Short-Term & Long-Term Disability Benefits

- Supplement Benefits

- Tuition Benefit

- Vision Insurance

- Employee Discounts and Perks

- Frequently Asked Questions

- Complaints and Concerns

- Sexual Misconduct and Sexual Harassment (Title IX)

- Racial and Ethnic Harassment

- Disability Discrimination

- Title IX Notice of Nondiscrimination

- Reporting a Complaint or Concern

- Submit an Anonymous Report

- Training

- FAQ

- Employee Handbook

- Employee Recognition

- Employee Life Cycle Resources

- Supervisor Toolkit

- Recruitment

- Developing Employees

- Building Teams

- Performance Management

- Supporting University’s Mission and Vision

- Managing Departures from Bethel

- Forms

- Student Employment

- Contact Us

Retirement Program - (401a)

Profit Sharing Defined Contribution Plan - Bethel contributes an amount equal to 2% of benefits-eligible employee's annual salary on an immediate vesting basis.

Bethel's Retirement Plan Provider: TIAA-CREF1.800.842.2888

Retirement Plan Document:

Retirement Program Summary Plan Description

Contact the Office of People and Culture at people-culture@bethel.edu or 651.638.6119 if you have questions.

Retirement Program - Voluntary Tax-Sheltered Annuities (403b)

Tax sheltering is a retirement planning method which allows a reduction from your salary before state and federal taxes are taken. You may purchase a TSA through the company authorized by Bethel and within limits prescribed by the IRS. The Office of People and Culture has further details on the TSA plan. To begin or change your reduction, fill out a Tax Deferred Annuity (403b) Form and submit it to the Office of People and Culture before the 15th day of the month that you would like your election to begin. Physical forms are also available in the Office of People and Culture.

2024 IRS Contribution Limits

| Under Age 50 | $23,000 |

| Age 50+ | $30,500 ($23,000 + $7,500 Catch-Up) |

Retirement Plan Document:

Retirement Program Summary Plan Description

TIAA - 2024 IRS Contribution Limit Flyer

To change your beneficiary(ies), visit tiaa.org/bethel and log in.

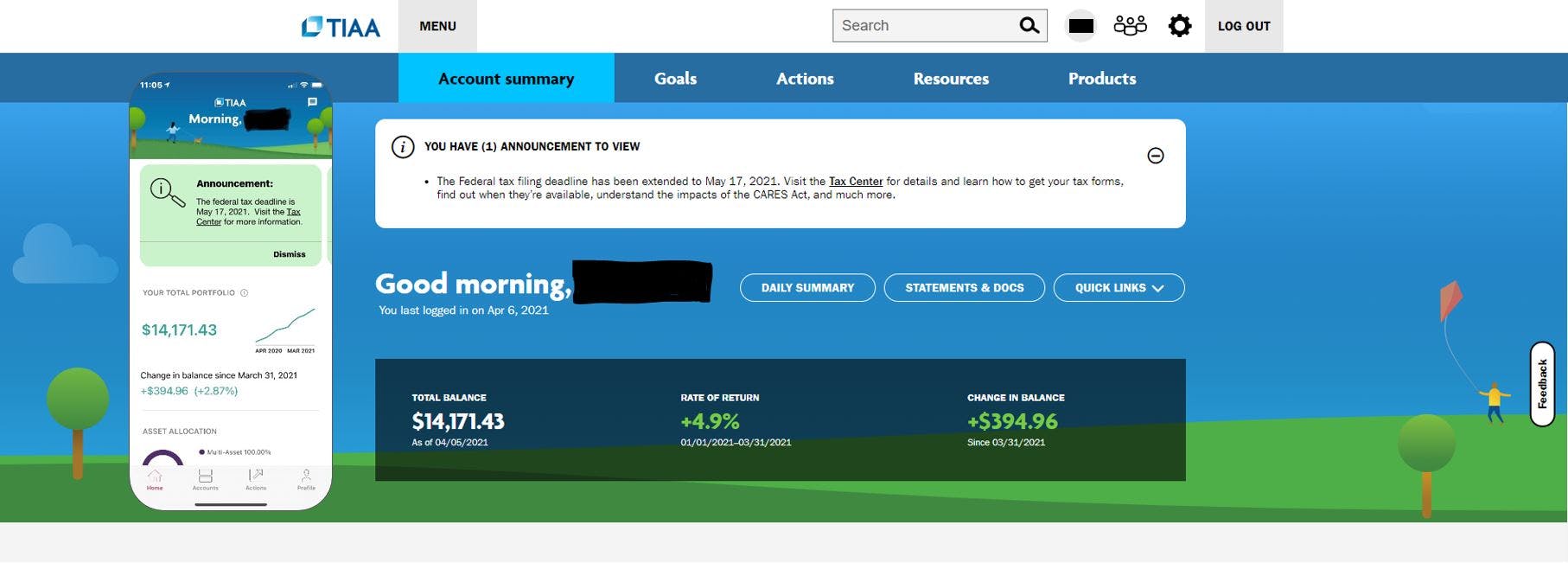

TIAA

What can you do through your online TIAA portal?

- Check your account balances and details, including year-to-date contributions

- Manage your investment options

- Add/edit beneficiaries

- Take out a loan

- Initiate a withdrawal or rollover

- View your pending transactions and required actions

- View statements

To sign up for an account, view the TIAA Enrollment Instructions PDF.